Zebit

Zebit is a progressive enterprise focused on easing the monetary strain many individuals experience due to the continuously rising cost of living. The company acknowledges that affording quality products through a single payment can be challenging for some, particularly those in underserved communities.

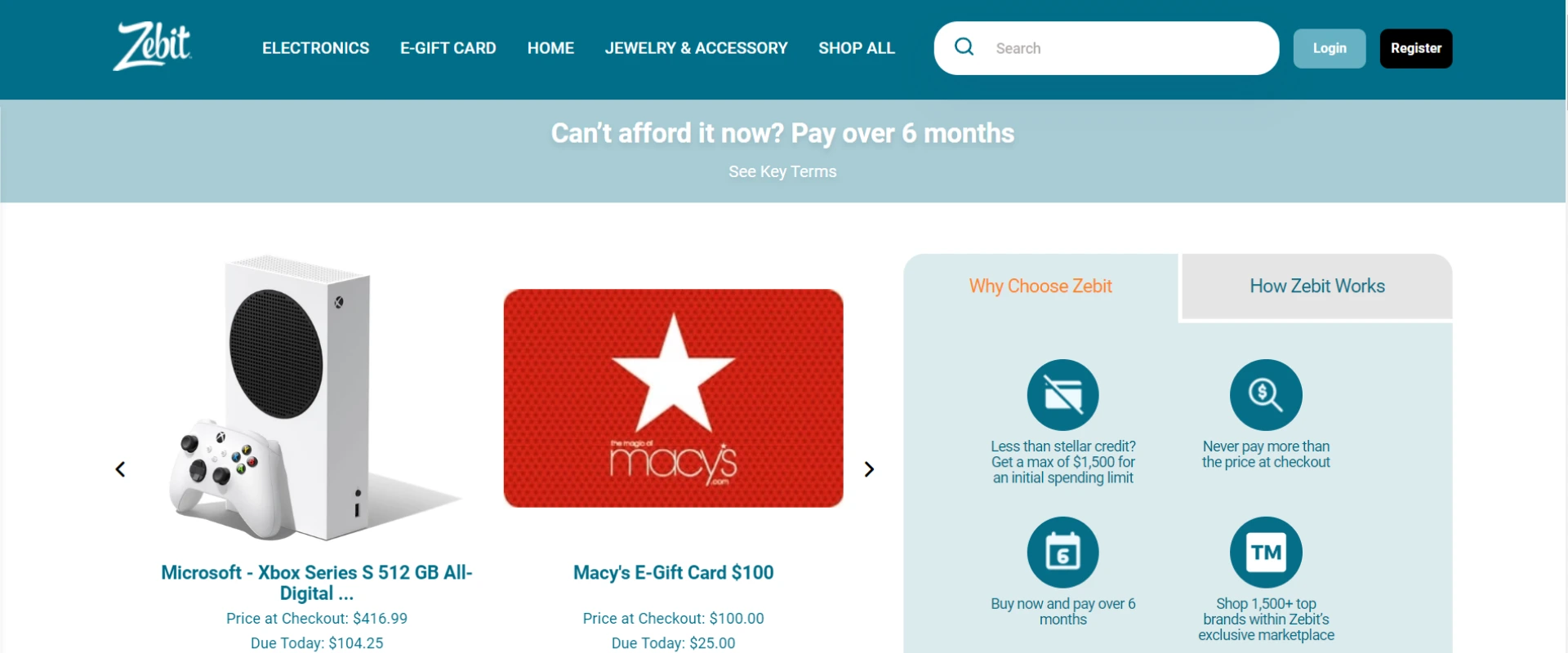

At its essence, Zebit is an all-inclusive online platform that offers an extensive selection of items, including household goods, electronics, furniture, and more, to accommodate a variety of customer requirements. The company's primary objective is to close the affordability gap by presenting a unique shopping experience that combines ease of use, adaptability, and accessibility.

A notable feature of Zebit is its installment payment option, which permits customers to distribute their purchase costs over six months. This inventive approach allows individuals to obtain the items they require without the financial stress of an immediate, sizable payment.

Besides its flexible payment plans, Zebit is committed to providing an outstanding user experience through its intuitive website. The platform showcases an extensive range of products, catering to diverse preferences while maintaining high quality standards. Moreover, the company places significant emphasis on prompt shipping and handling, ensuring customers receive their orders in a timely fashion.

Zebit's dedication to customer satisfaction is further demonstrated by its attentive customer support team, who are available to address any concerns or questions. The company also prioritizes data security and privacy, guaranteeing that all transactions occur in a protected environment.

Overall, Zebit is an inventive company offering a practical solution to the financial obstacles many people face in today's economic landscape. With a wide product assortment, user-friendly website, adaptable payment options, and an emphasis on customer satisfaction, Zebit is simplifying the process of obtaining essential household items.

No Credit Check*

Zebit stands out as a leading buy-now-pay-later (BNPL) retailer. Zebit offers an extensive selection of products for its customers. With a variety of benefits associated with purchasing from Zebit, it becomes an attractive option. Let's explore some of these enticing factors!

Shopping with Zebit is secure, as they do not disclose credit information to other credit bureaus. They also ensure that all customer personal data remains confidential.

Zebit provides an amazing online marketplace where you can buy numerous products now and make payments over a few months without incurring any hidden fees or interest charges.

Applying for a Zebit account is straightforward. Customers complete an online registration form, providing their email address, name, age, and other required information. Zebit does not check shoppers' credit scores. Instead, they gather information from credit agencies and assess whether you qualify for the process. They verify the user's identity, employment, and income during the application.

Zebit offers great convenience for customers by allowing them to make a 25% down payment and pay the remaining balance over the next six months. Regular repayments are crucial for costly items such as large appliances or laptops.

Zebit is an ideal choice for people seeking a one-stop-shop. With over 175,000 products, it ranks among the top BNPL companies. Customers can find electronics, small and large appliances, personal care items, baby products, meat, seafood, beverages, beauty products, home goods, kitchen accessories, and more.

Zebit features a vast array of products from over 1,500 leading global brands, such as Apple, Samsung, Sony, Ashley, Nintendo, and HP, across 80-plus categories.

Zebit also offers digital gift cards for restaurants, travel brands, and retail stores.

Customers can shop, make purchases, and track orders using Zebit's fully functional app, available for both iOS and Android devices.

Despite its many advantages, Zebit also has some drawbacks that potential customers should consider. Let's examine some of these less favorable aspects.

Zebit is currently only accessible to customers in the United States, excluding potential users from other countries who may be interested in the platform's services.

To apply for a Zebit account, customers must meet specific criteria such as having a steady income and verifiable employment. This requirement may exclude some individuals who are self-employed or have irregular income sources.

While Zebit does its best to ensure efficient shipping, some customers have reported longer-than-expected delivery times for their orders, which can be frustrating when waiting for essential items.

Although Zebit offers a wide variety of products, certain categories such as clothing and shoes are not available on their platform, limiting customers' choices.

Some shoppers have observed that the prices of certain items on Zebit can be higher compared to other retailers. This could be a disadvantage for cost-conscious customers who are seeking the best deals.

While Zebit protects customers' credit information, they also do not report positive payment history to credit bureaus. Consequently, customers who are looking to improve their credit score through timely BNPL payments will not benefit from using Zebit.

Zebit does not frequently offer promotions or discounts on their products. This lack of incentives may be disappointing for customers who enjoy taking advantage of sales and special offers when shopping.

Zebit has mixed reviews; some customers are pleased, while others are dissatisfied. Here is what we found:

Zebit's online reputation presents a mixed picture, with some customers expressing satisfaction while others report dissatisfaction. To provide a more detailed overview, we have compiled ratings from various review platforms:

Site Jabber: Zebit has a 2-star rating out of 5 on Site Jabber, indicating that some customers may have had less than satisfactory experiences with the company. This could be due to issues like delayed shipping, higher prices, or customer service concerns.

Trustpilot: On Trustpilot, Zebit fares better with a 3.8-star rating out of 5. This suggests that a significant number of customers are generally content with their experiences using the platform. Positive reviews may highlight factors such as the convenience of installment payments, the variety of products, or the user-friendly website.

Better Business Bureau (BBB): The Better Business Bureau gives Zebit a 3.09-star rating out of 5. While this rating is closer to the average, it still reflects that customers have had a range of experiences, both positive and negative. The BBB rating takes into account various factors, including customer complaints and the company's response to those complaints, which can influence the overall score.

In summary, Zebit's online reputation is varied, with some customers praising the platform and others expressing dissatisfaction. Prospective users should weigh both the positive and negative aspects before deciding whether Zebit is the right choice for their needs.

Zebit serves as a one-stop-shop offering an extensive selection of items for customers while ensuring a smooth shopping process. Here are the steps to guide you in acquiring your preferred product from Zebit.

1. Browse the Zebit website and navigate through the various product categories to find the item you wish to purchase.

2. Go to the search bar, write the item that you want to buy, and tap it. OR visit the relevant category and then choose the desired product from the popped-up list.

3. After selecting the product you want, you can opt for the preferred color. Next, review the form on the right side and select the payment frequency – weekly, bi-weekly, semi-monthly, or monthly. Once you've decided on the payment details, click on the orange button labeled "Get Started" below.

4. The product will be added to your cart. Within one to two clicks, you can complete your application process and (if approved) get it delivered to your doorstep.

While both Zebit and FlexShopper are popular options for shoppers seeking alternative payment methods, they differ in their approaches. Zebit operates as a buy-now-pay-later company, whereas FlexShopper follows a lease-to-own model. FlexShopper offers around 100,000 products from well-known brands, while Zebit boasts a more extensive selection with 175,000 items from top brands.

Both companies excel in their product categories. Zebit's offerings include electronics, furniture, jewelry, home goods, beauty items, appliances, and more. In contrast, FlexShopper provides customers with appliances, furniture, laptops, tablets, fitness equipment, cell phones, video games, TVs, wheels, tires, and other products, all under one roof. FlexShopper's leasing plans span 52 weeks, after which customers can own the products, while Zebit requires weekly payments. Both companies have mobile apps available on iOS and Android platforms.

There are similarities between Zebit and FlexShopper as well. To be eligible for their plans, customers must be US citizens and at least 18 years old. FlexShopper has a spending limit of $2,500, while Zebit starts with an initial spending limit of $1,500, which can increase if payments are made on time.

One advantage of Zebit is its openness to customers with poor credit scores and its commitment to charging zero percent interest rates on payments.

As the cost of goods continues to rise, rent-to-own and buy-now-pay-later stores are gaining traction among consumers. Zebit and Aaron's Rent are two leading retail outlets in the US market. Aaron's Rent was established in 1955 by R. Charles Loudermilk.

While Zebit operates as a buy-now-pay-later company, Aaron's Rent is a well-known lease-to-own retailer. Aaron's Rent primarily focuses on leasing electronics, appliances, computers, and furniture, selling products through both e-commerce platforms and physical stores. In contrast, Zebit conducts its business via its website and mobile app.

The application processes for both companies are relatively straightforward. For Zebit, applicants must be at least 18 years old and provide basic information when completing the application form. Similarly, Aaron's Rent requires applicants to submit their name, contact information, ID, income details, and Social Security Number (SSN).

In terms of payment plans, Aaron's Rent offers 12, 18, or 24-month schedules, while Zebit allows customers to pay off the remaining balance within six months after making an initial down payment.

Zebit, an online shopping platform, offers customers the advantage of buying items immediately while paying for them later without requiring credit checks. Rent-A-Center pursues a similar goal, aiming to improve the quality of life for those who cannot afford expensive appliances, furniture, and electronic devices.

Primarily operating through its website and mobile app, Zebit conducts its business online. In contrast, Rent-A-Center maintains a vast physical presence with over 3,000 brick-and-mortar stores and offers the perk of same-day delivery. Zebit's delivery times tend to be longer, usually taking about 7 to 10 days for customers to receive their purchases. Both companies emphasize providing high-quality products from well-known brands.

When it comes to payment plans, Rent-A-Center generally offers lease-to-own agreements, while Zebit focuses on buy-now-pay-later schemes. This variation in their approaches allows consumers to select the option that best aligns with their financial situation and preferences.

Zebit and Fingerhut are unique businesses, each with its own history. Zebit came into existence in 2015, whereas Fingerhut has been around for more than 70 years, having started in 1948. Fingerhut initially sold car seat covers and later evolved into a mail-order catalog company, broadening its product offerings to encompass items like dishes, tools, and towels.

Zebit allows customers to access loans up to $2,500 for purchasing items on their website, with repayment required in six-month installments. On the other hand, Fingerhut provides two credit account options: Fingerhut Fetti and FreshStart Credit Account. Customers can make payments on a monthly basis using credit until the full amount is settled.

Although Fingerhut presents a range of products, such as electronics, toys, beauty products, and clothing, its product categories aren't as numerous as those available on Zebit. Instead of offering in-house financing, Fingerhut partners with WebBank for financial services.

Both Zebit and Fingerhut maintain transparency regarding their fee structures, with neither imposing hidden charges. Additionally, Fingerhut doesn't necessitate an annual fee and even presents a 10% bonus through its payment reward initiative.

| Company Name | Zebit |

| Owner and CEO | Marc Schneider |

| Address | 9920 Pacific Blvd Suite 150 PMB #5733, San Diego, CA 92121 |

| Customer Service Email | help@zebit.com |

| Contact No | +1 888-848-8756 |

| Website | https://preview.zebit.com/ |

| BBB Rating | A+ as of 6/3/2023 (Accredited Since: 10/5/2022) |

Here are some important frequently asked questions about The Credit Pros.

To close your Zebit account, follow these steps:

It's important to note that before closing your account, you should ensure that:

Zebit is an online marketplace that allows customers to purchase items and pay over a six-month period. The platform features a wide selection of products from top brands, ensuring a smooth and hassle-free shopping experience for users. What sets Zebit apart is that it doesn't charge interest, application fees, late fees, or membership fees. There are no tricky eligibility criteria or heavy down payments required, making shopping on Zebit convenient and trustworthy.

^ We will issue you 35,000 Bonus Points with your paid purchase. The Smart TV is a 24" TV with apps for watching streaming videos. You may also use these Points for this or any other item we offer at our Reward Points Redemption Center. * According to Account terms. Certain restrictions apply.