Net First Platinum Card

The Net First Platinum Card offers a potential solution for individuals who have experienced credit denials in the past. This unsecured credit line grants up to $750, but what exactly does it entail, and how can you apply? Dive into the details below and learn how this unique financial product may serve your needs.

No Credit Check*

The Net First Platinum Card is part of the esteemed Horizon Card Services family. Since its inception in 2006, Horizon Card Services has cultivated a solid reputation with thousands of satisfied cardholders. The Net First Platinum Card functions primarily as a merchandise card, usable exclusively at the Horizon Outlet – a popular online retailer. The extensive catalog offers an array of products, including toys, tools, books, cookware, clothing, and more. However, it's essential to note that the selection may not feature many prominent manufacturers.

Applying for the Net First Platinum Card is a simple and streamlined process. Notably, it does not necessitate a credit check upon application, ensuring your previous credit missteps won't impede your approval chances. Additionally, the application does not inquire about your employment status and abstains from reporting details to credit bureaus monthly. These factors significantly increase the likelihood of individuals with poor or no credit obtaining an unsecured credit line of $750.

It's crucial to be aware that upon acceptance, the Net First Platinum Card automatically enrolls you in a monthly program offering supplementary benefits such as My Universal RX, My Privacy Protection, My Legal Assistance, and My Roadside Protect. Nevertheless, it's vital to assess whether the benefits provided justify the cost of the monthly plan.

The Net First Platinum Card presents a potential opportunity for those seeking an unsecured credit line despite an unfavorable credit history. However, we strongly advise carefully examining the terms and benefits before submitting an application.

As we further explore the world of the Net First Platinum Card, the following section will delve into the History of Net First Platinum, shedding light on the evolution of this unique financial product.

The Net First Platinum Card, a key player in the Horizon Card Services family, boasts an intriguing and progressive history. As we traverse through time, we uncover the milestones that have shaped this unique financial product, which has helped thousands of consumers access credit.

Horizon Card Services, the parent company of the Net First Platinum Card, was founded in 2006 with the mission to provide accessible credit solutions to a diverse range of consumers. The company's dedication to assisting individuals in establishing or rebuilding their credit history has led to its solid reputation and a rapidly growing clientele.

Over time, the company recognized the need for a specialized product that would cater to individuals with less-than-stellar credit histories. Thus, the Net First Platinum Card was born. This innovative merchandise card catered to a niche market by offering an unsecured credit line without the strict requirements and credit checks that other credit products mandated.

To provide cardholders with a unique shopping experience, Horizon Card Services forged an exclusive partnership with the Horizon Outlet, a popular online retailer. Through this alliance, the Net First Platinum Card enabled cardholders to access an extensive catalog of products, ranging from toys and tools to clothing and cookware. This partnership further solidified the company's commitment to delivering value to its customers, even if the selection lacked representation from some well-known manufacturers.

In response to market demands and customers' needs, the Net First Platinum Card evolved to offer a simplified application process that eliminated credit checks and inquired neither about employment status nor reported details to credit bureaus monthly. This streamlined process opened doors for individuals with poor or no credit to obtain an unsecured credit line of $750.

The Evolution of Net First Platinum: A Comprehensive Company History

Net First Platinum Card has introduced a monthly program with additional benefits to enhance their value proposition.

The program includes:

Cardholders are encouraged to carefully evaluate these benefits in relation to the cost of the monthly plan. Careful evaluation can help ensure that cardholders are getting the most value for their money.

The supplementary benefits offered by the Net First Platinum Card monthly program can provide the following advantages:

By evaluating these benefits and their associated costs, cardholders can make informed decisions about whether to enroll in the program.

In today's dynamic financial landscape, the Net First Platinum Card steadfastly maintains its position as a viable alternative for individuals seeking an unsecured credit line, despite previous credit challenges. The company's unwavering commitment to adapting and evolving ensures that it consistently addresses the needs of its cardholders, striving to enrich their lives and financial well-being.

As we look towards the future, we anticipate further developments and advancements in the Net First Platinum Card's offerings. Prospective users should prudently assess the terms and benefits associated with the card to make informed decisions regarding their financial pursuits.

Armed with a comprehensive understanding of the company's history, we now shift our focus to the contemporary landscape of the Net First Platinum Card. In doing so, we provide a discerning perspective on this distinct financial product's current features and the potential opportunities it presents to the discerning consumer.

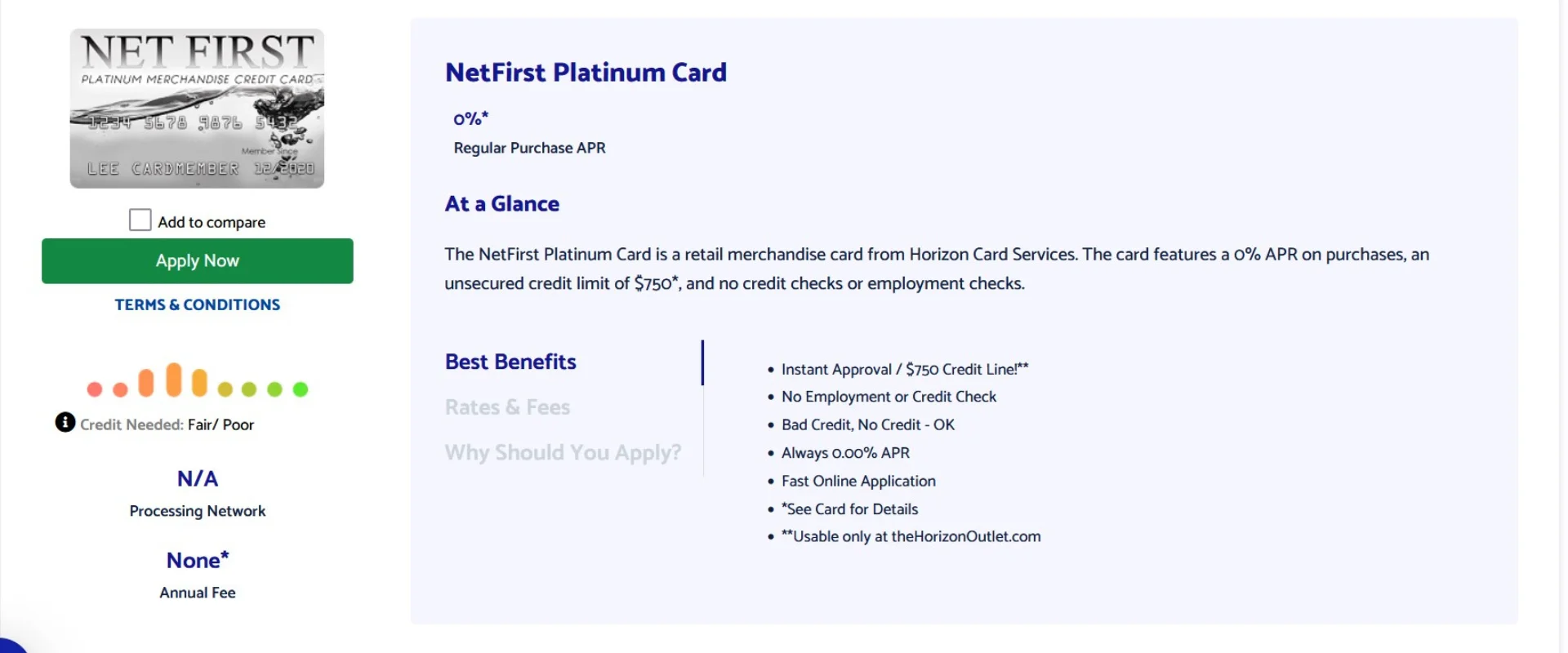

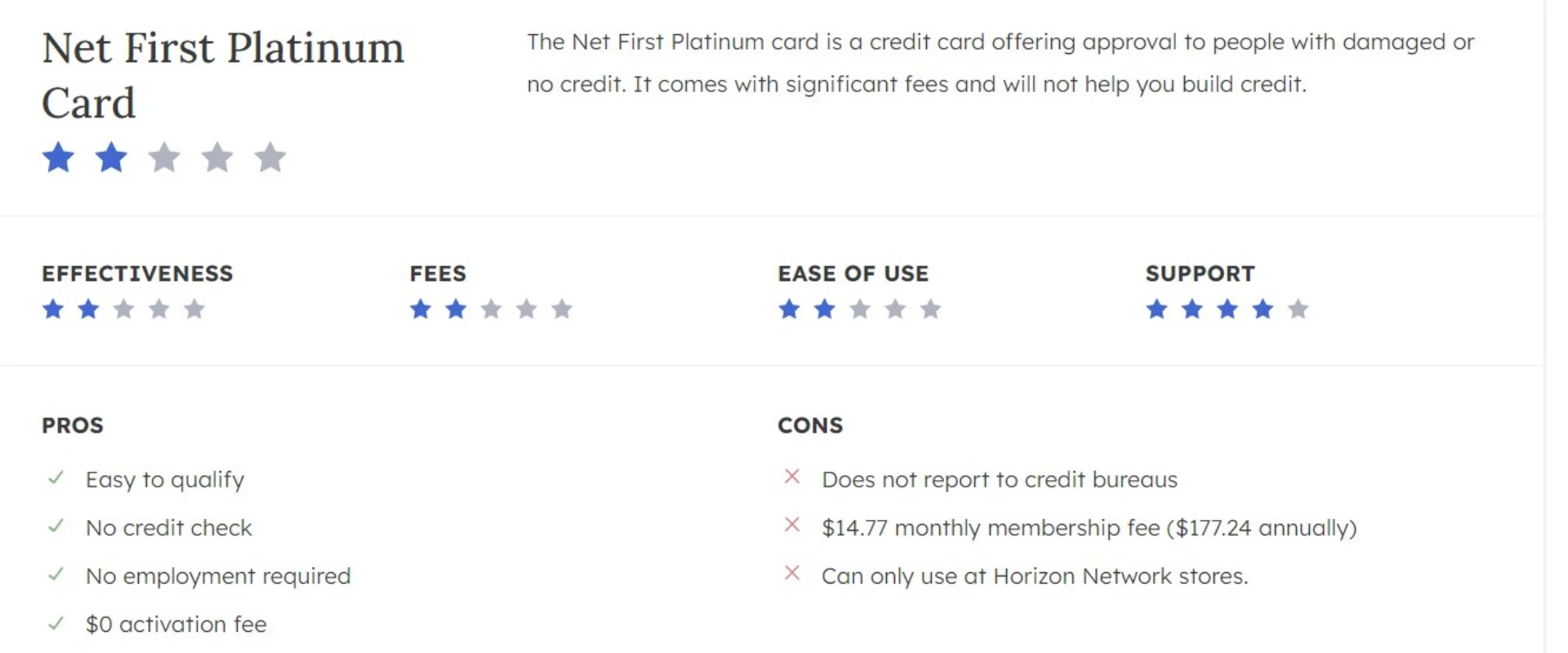

Discover the pros and cons for the Net First Platinum Card to determine if it's the right fit for you.

The Net First Platinum Card offers a variety of advantages designed to cater to individuals seeking to rebuild or establish their credit history while also enjoying exclusive benefits. In this section, we will outline the key pros of the Net First Platinum Card, providing you with valuable insights to help you determine if this financial product is the right fit for your needs.

New cardholders enjoy a 7-day free trial to evaluate the features of the Net First Platinum card. During this period, users can make purchases at the Horizon Outlet. If unsatisfied, they can cancel the card and only pay for the value of the purchased items. This unique offering is uncommon among most merchandise catalog cards or credit cards.

A significant advantage of the Net First Platinum card is its 0% APR on purchases. Operating on a buy now, pay later model, users aren't charged any interest on their purchases. However, a minimum payment that exceeds either $25 or 10% of the purchase price is required. This payment structure is more favorable than incurring interest charges on outstanding credit card balances.

Upon approval, users receive an initial unsecured credit limit of $750. Some consumer feedback indicates that users may receive up to $1,500 in starting credit lines. This initial credit line is considerably higher than the majority of subprime credit cards available.

Net First Platinum guarantees approval without credit or employment checks, as long as the applicant possesses a debit card. There is no need for a checking account to pay the membership fees. This feature simplifies the approval process for the Net First Platinum card.

The compulsory monthly fee for the Net First Platinum Card entitles all cardholders to additional Horizon Benefits. These include My Prescription Benefit, My Roadside Protection, My Legal Assistance Plan, and My Privacy Protection.

Net First Platinum Card's My Universal RX benefit allows users to save up to 50% on covered prescription drugs. However, users cannot access the list of permitted drugs until they sign up for the card.

According to its terms and conditions, Net First Platinum Card rewards users with up to one towing request or service call per month, but not more than three within a year. Coverage includes 15 miles per tow, and users must pay any charges beyond $50.

Net First Platinum offers users a one-time free 30-minute consultation session with a legal expert in their area of law interest through the My Legal Assistance Plan. This benefit can be valuable for users seeking legal advice.

All Net First Platinum cardholders benefit from unlimited privacy protection while using their card within the Horizon Outlet online portal. This feature provides peace of mind for online transactions.

The Net First Platinum card does not impose any annual fees, making it an excellent choice for individuals who prefer to avoid extra charges on their credit cards.

This card includes a credit monitoring feature, allowing users to track their credit scores and receive notifications of any changes or updates.

Net First Platinum provides various payment options, including online, phone, and mail-in payments, to facilitate timely payments for users.

Users can obtain up to three extra cards for family members or friends without incurring additional costs.

With no foreign transaction fees, the Net First Platinum card is ideal for individuals who frequently travel or make purchases from international vendors.

Net First Platinum provides users with online account management tools, enabling them to review account balances, examine transaction history, and adjust account settings from a computer or mobile device.

Net First Platinum offers an array of benefits, such as a 7-day free trial, 0% APR on purchases, an unsecured $750 starting credit limit, guaranteed approval, and Horizon Benefits. Some notable Horizon Benefits include My Prescription Benefit, My Roadside Protection, My Legal Assistance Plan, and My Privacy Protection. Net First Platinum presents an excellent opportunity for users to improve their credit score, establish credit history, and access a wide range of benefits.

By carefully considering the pros of the Net First Platinum Card, potential cardholders can make informed decisions about whether this financial product aligns with their needs and goals. With its unique features and benefits, the Net First Platinum Card can be a valuable tool for individuals seeking to enhance their financial standing and access exclusive benefits.

While the Net First Platinum Card offers various benefits, there are several factors that may make it less suitable for some users.

The primary disadvantage of the Net First Platinum Card is its restricted use, as it can only be utilized at the Horizon Outlet online store. This limitation significantly reduces its versatility compared to traditional MasterCard or Visa Cards.

A monthly membership fee is imposed, amounting to $177.24 annually. This cost is substantially higher than fees associated with many other reputable secured credit cards, particularly for those who pay their monthly balance in full. The annual expense surpasses that of numerous cash-back rewards and feature-rich travel credit cards.

As of January 25th, 2022, Net First Platinum ceased reporting to any credit bureaus, limiting the card's ability to help users build their credit.

Due to the card's lack of reporting to credit bureaus, it offers limited opportunities for users to build or improve their credit.

The Net First Platinum Card does not allow balance transfers, making it less flexible for users seeking to consolidate their debt.

The card lacks a rewards program, limiting the incentives and benefits users may receive from their spending.

The Net First Platinum Card may impose high fees for certain services, such as late payments or returned payments, which can increase the card's overall cost.

As the card is not a traditional MasterCard or Visa Card, it may not be accepted at many merchants, reducing its practicality for everyday use.

The card's high initial credit limit and exclusive usage at the Horizon Outlet online store may encourage overspending, leading to financial strain for some users.

The Net First Platinum Card, despite its benefits, has several drawbacks that may make it less suitable for some users. Limitations include its exclusive usage at the Horizon Outlet online store, a relatively high annual membership fee, and the discontinuation of credit bureau reporting. Additional cons encompass limited credit building opportunities, the absence of balance transfers and rewards programs, high fees for specific services, restricted card acceptance, and a potential for encouraging overspending.

Although Net First Platinum holds a BBB accreditation and an A+ rating, the company's account on the Better Business Bureau once featured an alert stating that the unsecured credit line could only be used for purchasing merchandise through the company's online store. Consumers frequently report that the product selection is limited and of inferior quality, often seeking refunds as a result.

In some instances, the company provides only a partial refund in response to complaints. However, when the Better Business Bureau processes these complaints, Net First Platinum offers an explanation for its stance and typically issues a full refund. Therefore, if you file a complaint with the Better Business Bureau, you will likely receive a full refund from Net First Platinum.

Moving forward, here are the ratings for Net First Platinum as collected and evaluated by various third-party independent review companies:

The Group One Platinum Card is a retail card tailored for individuals with poor or no credit history, while the Net First Platinum is a merchandise credit line rather than a conventional credit card, designed for online shopping. Both cards are compatible with Horizon Outlet purchases. Applying for the Group One Platinum Card doesn't require a credit check, and the process is hassle-free. Similarly, the Net First Platinum Card can be obtained without credit or employment checks.

A notable advantage of the Group One Platinum Card is its acceptance of applicants with poor or bad credit, offering relatively high approval chances. However, like the Net First Platinum Card, it imposes a mandatory monthly fee of $14.77, does not report to credit bureaus, and provides no cash back or rewards.

The Freedom Gold Card, issued by Horizon Card Services, is designed specifically for users with poor or bad credit seeking online shopping opportunities without qualifying for a traditional card.

Like the Net First Platinum Card, the Freedom Gold Card caters to applicants with fair credit and grants approvals. Additionally, it includes travel assistance insurance. However, similar to the Net First Platinum Card, users must pay an annual fee of $177.24.

The Boost Platinum Credit Card, another option to consider alongside the Net First Platinum Card, is issued by Horizon Card Services as well. Both cards have comparable features, such as the absence of sign-up bonuses, cash back, rewards, or additional credit card advantages.

You can use your Net First Platinum Card and place orders for your favorite merchandise items at the Horizon Outlet Shopping Site. Below are the step to place an order for the Net First Platinum Card:

Visit the official Horizon Outlet website at www.horizonoutlet.com.

Out of the various product categories, choose your desired option and select the sub-category you are looking for.

You will find various options for the product you are looking for. Check the pricing and features that suit your needs and select the product that you intend to purchase.

Read the details of the product that you have selected and decide if you want to proceed ahead with the purchase. If you opt for the product, click on add to cart for all the products you have decided to buy.

If you already own a Net First Platinum Card, you must log in with your 16-digit shopping card number to enter your chosen product(s) into the cart.

However, if you haven’t yet signed up for your Net First Platinum Card, click here to create your profile.

The Net First Platinum Card is well-known and offers various promises to its users, such as approval for those with poor or no credit, no credit checks or employment verification, and an unsecured credit limit of $750. While it might seem appealing for those looking to improve their credit scores, the card does not report account activity to any credit bureaus.

The card's website mentions its credit monitoring policy as a benefit and provides educational resources on building credit. However, the Net First Platinum Card itself does not contribute to credit-building. The card is limited in usage, comes with high fees, and is generally considered a poor choice for many users.

The Net First Platinum Card can only be used at the Horizon Outlet, which offers a limited selection of merchandise. Additionally, the card's fees make it an unattractive option. Ultimately, the Net First Platinum Card is an inflexible and costly merchandise credit line that is not suitable for those looking to build credit.

^ We will issue you 35,000 Bonus Points with your paid purchase. The Smart TV is a 24" TV with apps for watching streaming videos. You may also use these Points for this or any other item we offer at our Reward Points Redemption Center. * According to Account terms. Certain restrictions apply.