Freedom Gold Card Review

Freedom Gold Card is an unsecured or merchandise credit card that is particularly famous among those who have bad credit scores. It is issued by Horizon card services, which have launched different credit cards for everyone.

People are praising the Freedom Gold card because it provides some critical benefits like legal assistance, roadside protection, etc.

However, there are lots of people out there who have very little knowledge about it.

Here, you will learn everything. In this review, we will look at the complete details of the Freedom Gold card to help you determine if it's appropriate for you. So, stay till the end.

No Credit Check*

Freedom Gold card is issued by Horizon Card Services- a reputable company that provides credit cards for everyone, including those with bad credit scores or who do not have access to any traditional credit cards.

In addition to Freedom Gold, the other cards that the company offers are:

Note that the company does not attempt to claim to improve your credit history. It also does not report to any credit bureaus or any credit-issuing entity. A lot of people also mistook it for baking and insurance companies.

The truth is- Horizon card services only offer unsecured credit cards, which you can use to shop only at Horizon outlet.

Horizon has been serving people since 2006. Over a decade and a half has passed, and it is still offering top-notch services to those who are unlucky with their credit scores.

Currently, it has thousands of satisfied cardholders. That’s not it. Everyday, new users apply for its credit cards to enjoy valuable benefits.

There is no denying that the Freedom Gold Card has lots of advantages. Here are some of the top ones you should know:

Freedom Gold cards are not all benefits. It also has some disadvantages which you should know in advance:

The Freedom Gold Card has received mixed evaluations in terms of reviews. Some cardholders have stated that the card has helped them improve their credit scores. Some, on the other hand, have complained about high costs, poor customer service, and unexpected charges.

Here are some legit customer reviews of the Freedom Gold card:

"This freedom card is great for me because I have a poor credit score. But the whopping annual fee is a big minus point," says Rene H.

"The Freedom Gold Card is a good alternative because it does not need any credit or employment checks during the application process. Also, the application is quick and simple. I really like this card," says Florencia.

Apart from student loans, I had no credit history when I applied for this card. I applied on their official website and honestly felt that my application would be rejected for sure. To my surprise, it was accepted! This credit card helped me build my credit. I highly recommend this card," says Layla D.

"I got accepted shortly but the thing I dislike about the Freedom Gold card is that I can use it on selective items and have to pay for the shipping separately," says Leigha W

There are dozens of more reviews on different platforms. When you read them, it gets clear that most people have recommended this card, while a few have disliked it as well.

Now, it's time for some comparisons.

Both the Freedom Gold and the Net First Platinum are credit cards intended for persons with poor credit or no credit history. Both are almost the same:

The Freedom Gold card is suitable for those who don't shop much, while those who spend more money should get a Platinum card.

Both Freedom Gold card and Net First Platinum are issued by Horizon and can only be used at the Horizon outlet.

Both cards come with a $750 credit line.

Both deduct monthly subscription fees ($14.77). Annually, that's roughly $177.

Horizon offers towing services per year for both Freedom Gold card and Net first platinum card holders.

A Group One Platinum is another retail card issued by Horizon. It also offers almost the same benefits as the Freedom Gold Card.

Just like the Freedom Gold Card, Group One Platinum has different kinds of fees, but the two that frustrate consumers the most are:

There is 0 percent APR on Freedom Gold and Group One Platinum cards.

You have to be at least 18 years old to get your hands on these horizon cards.

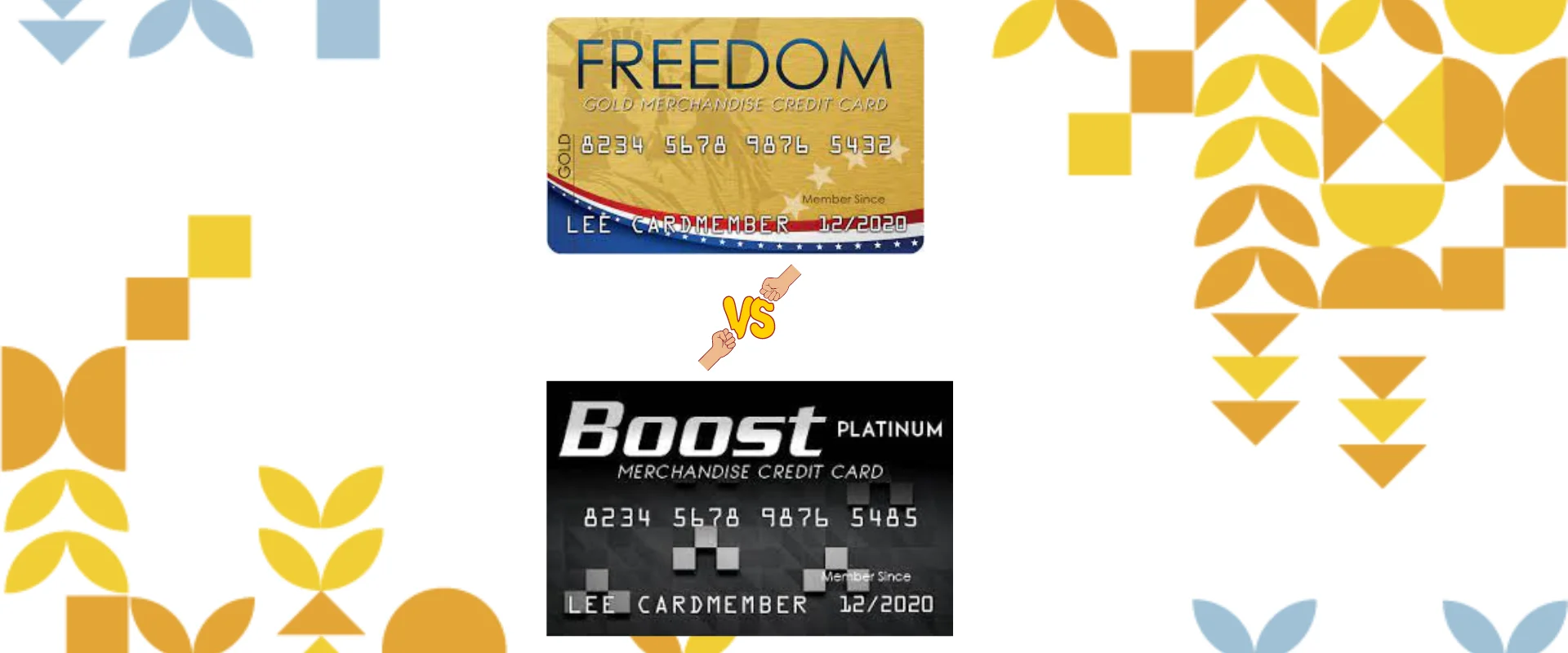

People also look for a comparison between Freedom Gold and Boost Platinum cards. Both are the same when it comes to benefits.

Both Freedom Gold Card and Boost Platinum offer a credit line of $750.

You will enjoy a 7-day free trial for both Freedom Gold Card and Boost Platinum.

Both Freedom Gold and Boost Platinum offer lots of additional benefits, like:

To place an order with the Freedom Gold Card, follow these steps:

Step 1: First, apply for the card on the official websiteofficial website and wait for approval before making a purchase with it. When everything gets done, check whether the card has become operational or not. If it is, then you can place an order on the Horizon outlet with it.

Step 2: Go to the Horizon store where you wish to make a purchase and add the products to your shopping cart.

Step 3: When you are ready to complete your purchase, select the credit card payment option and enter the details for your Freedom Gold Card. You must provide your credit card number, expiration date, and security code (usually located on the back of the card).

Step 4: Confirm your purchase.

It's crucial to know that, like any credit card, the Freedom Gold Card has a credit limit. Make sure you are aware of your credit limit and don't go over it when making purchases. Furthermore, you will not be able to pay for the shipping. So, keep these two factors in mind before confirming the purchase.

Horizon Card Services is a company that specializes in offering credit cards to clients who have limited or no credit options. You have already read everything about its Freedom Gold, Boost Platinum, Net First Platinum, and Group One platinum merchandise credit cards.

Here is some important company information you should know:

^ We will issue you 35,000 Bonus Points with your paid purchase. The Smart TV is a 24" TV with apps for watching streaming videos. You may also use these Points for this or any other item we offer at our Reward Points Redemption Center. * According to Account terms. Certain restrictions apply.